| product | lever |

|---|---|

| gold | Fixed 1:100 |

| silver | Fixed 1:100 |

| index | Fixed 1:100 |

| Crude oil, natural gas | Maximum 1:100 |

| Foreign exchange currency | Fixed 1:100 |

Note: Regardless of how the account leverage is adjusted, the gold fixed leverage is 1:100; the index’s fixed leverage is 1:100 and the crude oil is fixed at 1:100.

The specific leverage application threshold is as follows:

| Available leverage | Minimum deposit | Maximum funding limit |

|---|---|---|

| 1:100 | $500 | >$250000 |

For the same account, if there are multiple accounts with the same name, the funds of the same name account are also included in the maximum fund limit of the account; the different background accounts opened by the same ID card are all counted as the maximum fund limit; the total sub-account of MAM multi-account management The total amount of funds is also counted as the maximum funding limit.

When the net worth fund is greater than the original foreign exchange leverage range: the email will be notified to the customer that the net value exceeds the leverage requirement and the customer needs to reduce the leverage or withdrawal. The platform will process it after receiving customer feedback, and if the customer does not have feedback, it will force a reduction in foreign exchange leverage.

How to apply for modification of Forex leverage: You can log in to the background, select the option “My Account – Trading Account Settings” on the left side of the page in the background and click Submit to modify the application at “Leverage Modification”. After the modification, please be sure to confirm that the modification has been completed in the account.

Positions modify foreign exchange leverage: If you have a position, you can still apply for a change in foreign exchange leverage, but it may affect the margin of your order.

Margin calculation:

Prepayment (margin) calculation currency description: The currency in the middle of the currency pair (base currency) is the calculation formula for the prepayment currency, foreign exchange, silver, and crude oil, as follows:

Margin = Lots * Contract Size * Market Price / Account Leverage * Margin Percentage of the symbol (Margin Percentage)

Note: If the symbol is not settled in US dollars, you need to settle the foreign exchange price of the currency against the US dollar.

Example:

(1) If the customer trades a standard lot of EURUSD at 1.06865 and the trading account has a foreign exchange leverage of 1:100, then the prepaid amount is calculated as follows:

1*100,000*1.06865/100*100%=1068.65USD

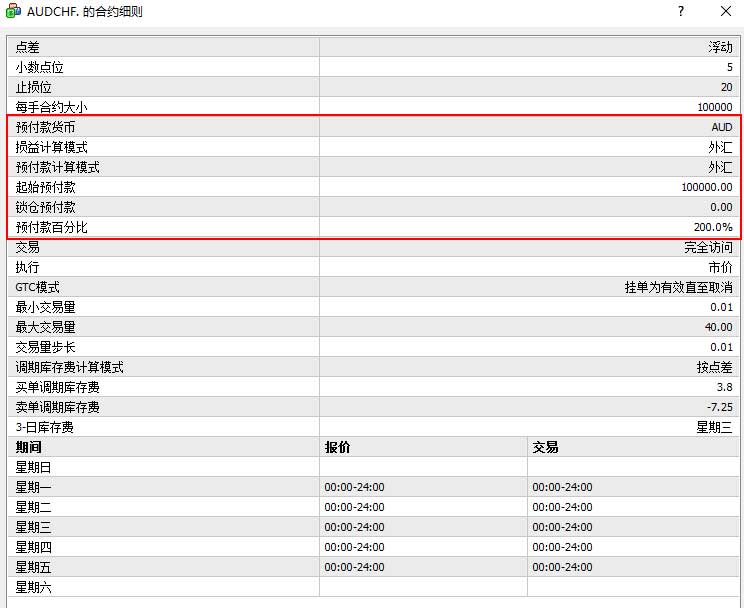

(2) If the customer trades a standard lot of AUDCHF at 0.733930, and the quoted price of the AUDUSD is 0.759035 and the trading account’s foreign exchange leverage is 1:100, then the prepaid amount is calculated as follows:

1*100,000*0.759035/100*200%=1518.07

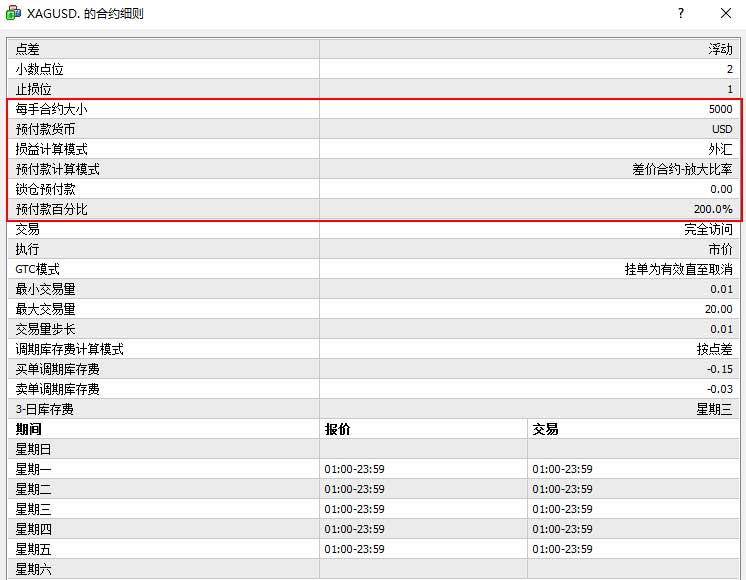

(3) If the customer trades a standard lot of XAGUSD at 15.90 and the trading account has a foreign exchange leverage of 1:100, then the prepaid amount is calculated as follows: 1*5000*15.90/100*200%=1590.00

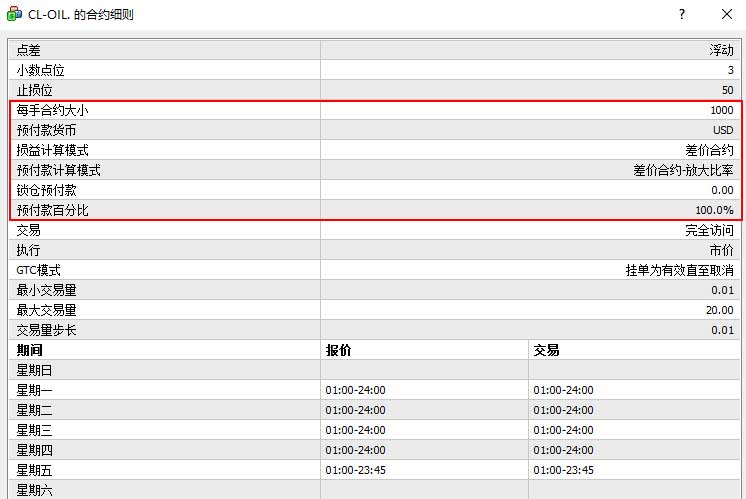

(4) If the customer trades a standard hand Cl-Oil at 46.506 and its trading account leverage is 1:100, then the prepayments used are calculated as follows: 1*1000*46.506/100*100%=465.06

The calculation formula for gold and CFD is as follows:

Margin = Lots * Contract Size * Market Price * Margin Percentage of the symbol

Note:

(1) Gold and CFD The margin is not related to the leverage of the trading account. The gold fixed leverage is 200 times and the CFD leverage (except CHINA50) is 100 times.

(2) If the trading instrument is not settled in US dollars, it is necessary to settle the exchange rate of the currency against the US dollar.

For example:

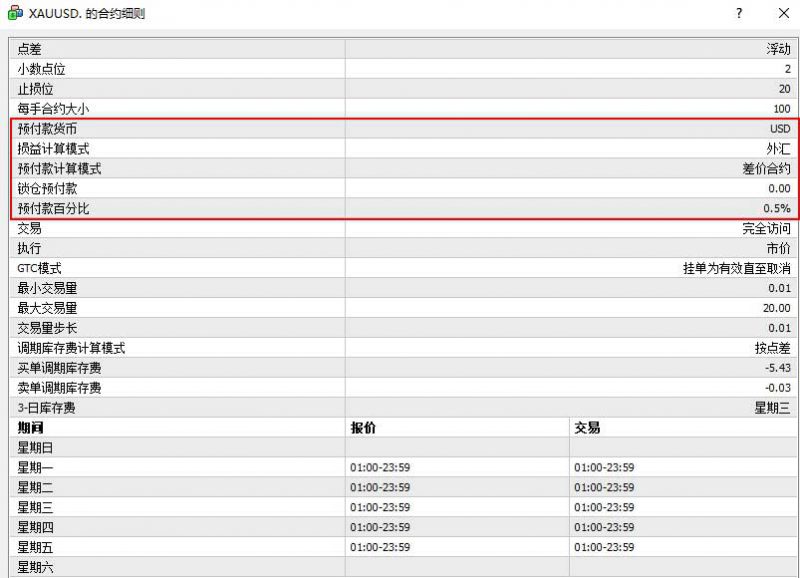

(1) If the customer trades a standard lot of XAUUSD at 1337.52 and its trading account leverage is 1:100, then the prepayments used are calculated as follows:

1*100*1337.52*0.5%=668.76USD

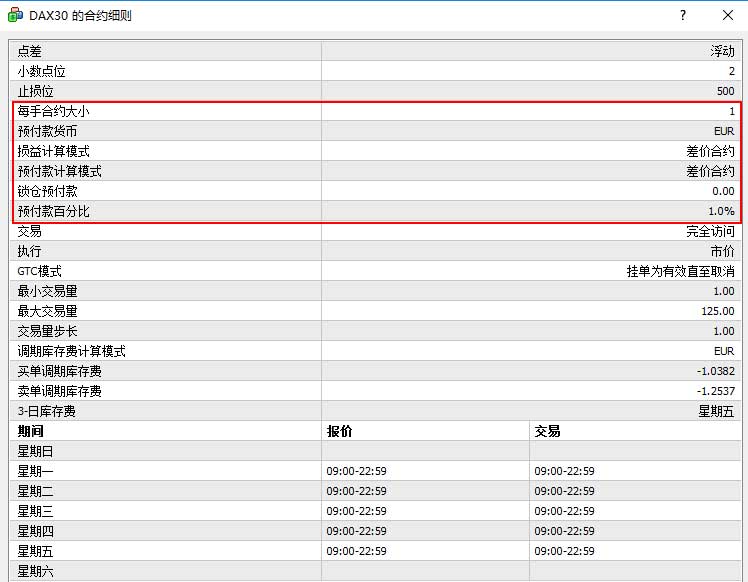

(2) If the customer trades a standard lottery DAX30 at 12444.75, and the quoted price of the EURUSD is 1.13236 and the trading account leverage is 1:100, the prepaid amount is calculated as follows: 1*1*12444.75* 1.13236*1%=140.92USD

Wellcome to ES markers

Wellcome to ES markers